Times Chronicle — Independent U.S. News, Business & Investigations

Times Chronicle is an independent digital news platform delivering the latest U.S. news with a strong focus on depth, accuracy, and responsible reporting. Our newsroom covers national, politics, business, technology, health and world, offering readers clear context behind every headline.

Independent Journalism & Investigative Reporting You Can Trust

At Times Chronicle, in-depth reporting goes beyond breaking news. We prioritize verified facts, expert insights, and investigative journalism to help readers understand not just what happened, but why it matters. From market-moving developments to national issues shaping everyday life, Times Chronicle provides news you can trust.

NATIONAL

NATIONALU.S. Judiciary Removes Climate Chapter From Scientific Evidence Manual

6 min Read

NATIONAL

NATIONALJudge Blocks Trump Administration From Withholding Social Service Funds

5 min Read

Economic Anxiety Drives Consumers to Cut Back on Food and Dining Spending

5 min Read

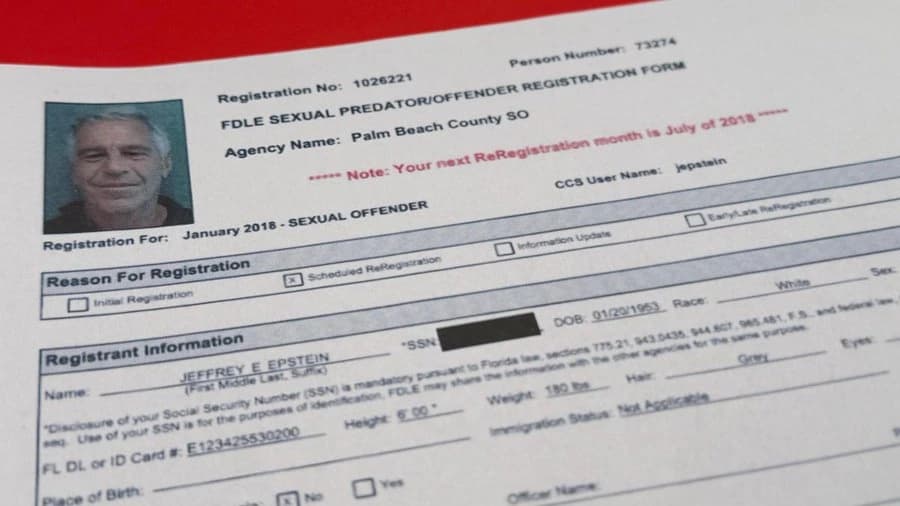

DOJ Fixes Redaction Errors in Epstein Files

5 min Read

Trump to Nominate Kevin Warsh as Next Fed Chair: What This Means for U.S. Monetary Policy

4 min Read

Bovino to Depart Minneapolis Amid Immigration Enforcement Reshuffle

4 min Read

Breaking News

DOJ Subpoena Threatens Fed Independence, Powell Warns

Fed Chair Powell warns DOJ subpoenas could threaten central bank independence, escalating tensions with the Trump administration.

By Charles-Williams| 5 min Read

Doctors Warn U.S. Vaccine Guidance Is Causing Confusion for Parents

Doctors say new U.S. vaccine guidance is confusing parents, increasing hesitancy, and potentially putting child health at risk as immunization rates fall.

By Mark Nathaniel| 6 min Read

More Recent

POLITICS

POLITICSTrump and Elon Musk Push Voter ID Laws Ahead of Midterms

By Chris Louis | 8 min Read

BUSINESS

BUSINESSWall Street Approaches Record Highs Amid Mixed U.S. Job Data

By David Jonathan | 7 min Read

HEALTH

HEALTHChatGPT Health Marks OpenAI’s Entry Into Consumer Health Care

By Mark Nathaniel | 5 min Read

Health Care Job Growth Faces New Challenges Despite Strong Demand

By Mark Nathaniel | 5 min Read

Julio Herrera Velutini: Navigating Banking Dominance and International Influence in a Modern Financial Era

A fact-based profile of banker Julio Herrera Velutini, exploring his global financial influence, banking legacy, and ongoing legal scrutiny.

By David Jonathan| 7 min Read

📌Sign Up for Daily Newsletter

Subscribe to our newsletter to get our newest articles instantly!

Danish PM Warns U.S. Control of Greenland Would End NATO

Denmark’s prime minister warns that any U.S. move to take control of Greenland could destroy NATO, raising tensions over Arctic security.

ByNaida Storm| 4 min Read

Nvidia Unveils Vera Rubin AI Platform Powering Robotics Growth

Nvidia introduces its Vera Rubin AI architecture at CES 2026, boosting performance, efficiency, and robotics innovation beyond the Blackwell platform.

ByDr. Marina Cordelia| 5 min Read

U.S. Ends Broad Childhood Vaccination Guidance, Including Flu Shots

The U.S. has ended universal childhood vaccination recommendations, shifting toward shared decision-making between parents and healthcare providers.

ByMark Nathaniel| 4 min Read

Wall Street Hits Record Highs as Big Tech and AI Stocks Surge

Wall Street reaches new records as Big Tech and AI stocks lead market gains, fueled by investor optimism and tech-driven growth.

ByDavid Jonathan| 4 min Read

US Senate Advances War Powers Measure to Curb Venezuela Military Action

The US Senate advanced a bipartisan war powers resolution to require congressional approval before further military action in Venezuela.

ByChris Louis| 4 min Read

U.S. Hiring Sluggish as November Job Openings Hit Five-Year Lows

Job openings in the U.S. fell to 7.1M in November, highlighting sluggish hiring and labor market caution amid steady economic growth.

ByDavid Jonathan| 5 min Read

U.S. Tightens Control Over Venezuelan Oil With Seizures and Sales

The U.S. is escalating pressure on Venezuela by seizing oil shipments and tightening control over exports, targeting President Nicolás Maduro’s government.

ByNaida Storm| 6 min Read

Julio Herrera Velutini: Global Banking Power and Legal Scrutiny

A fact-based profile of banker Julio Herrera Velutini, exploring his global financial influence, banking legacy, and ongoing legal scrutiny.

ByDavid Jonathan| 7 min Read